Global technology markets are entering a new phase of strain as surging memory chip prices intensify the ongoing semiconductor shortage. For Nigeria, the ripple effects could translate into a 15 – 20 per cent increase in phone price levels if supply pressures persist into the next quarter

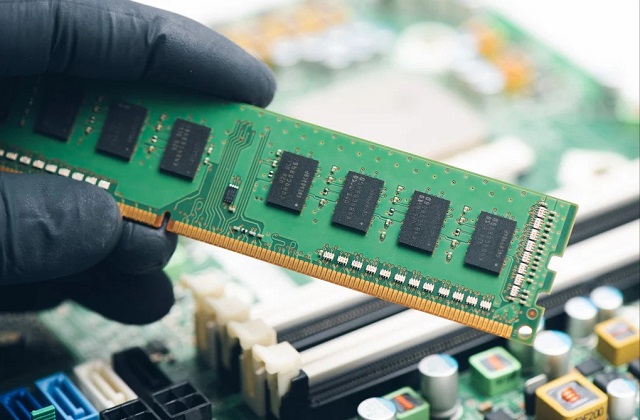

While attention has largely focused on advanced AI processors, the sharpest escalation is occurring in memory chips, specifically DRAM (Dynamic Random Access Memory) and NAND (Flash Memory), which are essential to smartphones, PCs, and vehicles.

According to Bloomberg data, spot prices for DRAM have surged more than 600 per cent in recent months. NAND prices have also climbed as artificial intelligence infrastructure expands global storage demand.

This shift reflects a structural realignment rather than a short-term disruption.

Massive AI infrastructure investments led by hyperscalers such as Amazon have redirected fabrication capacity toward high-bandwidth memory (HBM), a critical component for AI accelerators. This shift has tightened supply for conventional memory used in consumer devices.

Market analysts now describe the situation as a memory “supercycle,” breaking the industry’s traditional boom-and-bust pattern. Historically, memory cycles lasted three to four years. According to Jian Shi Cortesi of GAM Investment Management, the current cycle has already exceeded previous ones “both in length and magnitude,” with little evidence of demand momentum softening.

Financial markets reflect the divide. A Bloomberg gauge of global consumer electronics makers has fallen roughly 10 per cent since late September, while a basket of memory manufacturers has surged about 160 per cent over the same period. Shares of SK Hynix, a key high-bandwidth memory supplier to Nvidia, have climbed more than 150 per cent.

By contrast, downstream manufacturers reliant on affordable memory supplies are under pressure. Nintendo has warned of margin compression linked to shortages. Qualcomm shares declined after signaling memory constraints that could limit phone production. PC makers such as Lenovo and Dell have also retreated from recent peaks amid concerns that rising chip costs could dampen demand.

The divergence underscores a widening gap between component producers and device assemblers.

Memory is central to modern smartphone performance. Higher DRAM and NAND capacities power AI-enabled features, high-resolution imaging, and multitasking capabilities. Rising memory costs, therefore, feed directly into the bill of materials.

Even in a moderate demand environment, a constrained memory supply can limit production volumes. Qualcomm’s recent indication that memory shortages may restrict handset output highlights the risk of scarcity extending beyond price increases into availability challenges.

Compounding the issue, a foundry such as TSMC is prioritising higher-margin AI-related contracts at advanced nodes. Combined with the reallocation of capacity toward high-bandwidth memory, this limits flexibility in supplying traditional mobile processors and storage components.

For Nigeria, the likely outcome is not immediate widespread stockouts, but gradual upward revisions in retail pricing.

Nigeria’s electronics market remains heavily import-dependent, with minimal semiconductor manufacturing capacity. Retailers are, therefore, exposed to global cost shifts and supply volatility.

Distributors in major commercial hubs such as Lagos’ Computer Village are closely monitoring global trends. Some are securing inventory ahead of anticipated adjustments, while others are maintaining leaner procurement cycles to manage uncertainty.

Duration risk remains a key concern. Fidelity International’s Vivian Pai recently observed that while markets may be pricing in normalization within one to two quarters, industry tightness could persist through the rest of the year. If that proves accurate, manufacturers will have limited room to absorb higher component costs without passing them through to consumers.

Mid-tier smartphones, especially those balancing affordability with competitive performance, are likely to face the greatest pressure. Manufacturers may respond by offering lower base storage variants, delaying feature upgrades, or raising prices incrementally across product lines.

Parallel imports could increase if global scarcity intensifies, potentially raising concerns about warranty coverage and after-sales support.

Globally, firms are attempting to mitigate exposure by locking in long-term supply contracts, raising product prices, or redesigning devices to use less memory. However, semiconductor fabrication is capital-intensive and slow to scale. New fabrication plants require years to build, and expanding high-bandwidth memory output involves complex processes that cannot be rapidly accelerated.

For Nigeria, the episode underscores the importance of strengthening digital resilience. While domestic chip fabrication remains unlikely in the near term, expanding local device assembly, promoting repair ecosystems, and supporting component recycling could help cushion future supply shocks.

If projections hold, Nigerian buyers may begin seeing incremental price adjustments within weeks. Mid-range Android devices are likely to record the most noticeable changes, while premium models, already positioned at higher price points, may see more measured increases.

As it stands, AI’s explosive growth is reshaping semiconductor allocation patterns, and memory, once viewed as a product with prices that rise and fall in cycles, is behaving like a sustained constraint.

The widening gap between stock market winners and losers reflects the magnitude of this transition. As AI infrastructure spending accelerates globally, consumer electronics markets, including Nigeria’s, must adjust to a new cost environment.

Whether the squeeze proves temporary or evolves into a prolonged recalibration will depend on how quickly semiconductor capacity expands. For now, the trajectory suggests continued upward pressure on global electronics pricing, and Nigeria’s phone price expectations may have to adjust accordingly.