For years, the African fintech hype has been dominated by consumer-facing neobanks. However, the next wave of value may come from building the operating system for the continent’s massive, offline, trust-based economies.

The prime example of this thesis is Coopify, a Nigerian fintech building the core infrastructure for the cooperative finance sector, a multi-billion-dollar industry that serves as a primary source of credit for millions, but has historically run on paper ledgers.

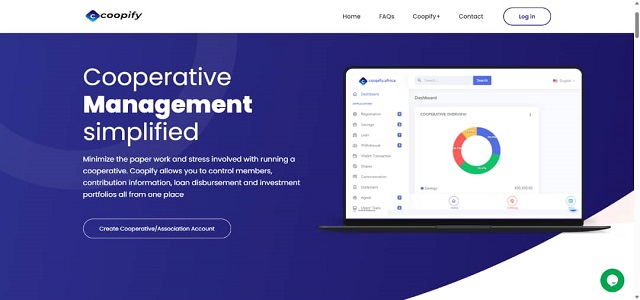

Coopify (www.Coopify.africa) started as an on-premise solution for the staff cooperative of a major Nigerian bank but has evolved into a scalable, self-service SaaS platform. “We knew the product worked, but the high-touch enterprise model was a bottleneck,” explains co-founder and Chief Marketing Officer, Ogunlade Oluwole.

His insight was to rebuild it as a self-service, cloud-based platform. “Imagine having an idea for a cooperative and launching it in the next hour. Onboarding, administration, payment collection, and loan management, all sorted.” It is like taking a system that runs on paper and putting it on modern, secure rails.

Building the product was only half the battle. To acquire customers at scale, Coopify deployed a two-pronged strategy. “Our first move was to dominate the digital conversation,” Ogunlade says. “We had to own the high-intent keyword ‘cooperative management in Nigeria’.”

The team invested in a focused mix of paid Search Engine Marketing (SEM), making Coopify the first choice for any cooperative leader searching for a solution.

However, understanding that this market runs on trust, they knew digital ads alone wouldn’t suffice. The second part of the playbook was a robust offline partnership strategy, where the team engaged directly with the leadership of cooperative unions and community financial groups, building the grassroots relationships needed to drive real adoption.

The most significant is the platform’s upcoming partnership with a leading Nigerian bank. Co-founder Shola Ogunniyi believes this “will give grassroots cooperatives direct access to more capital for loans and the ability to securely keep their funds in a trusted commercial bank, bridging the gap between the informal and formal financial sectors.”

Founded in 2019 by Ope Adelaja, Olushola Ogunniyi, and Oluwole Ogunlade, the platform has already established itself as a leader in cooperative management application as it is already serving 1,700 cooperative groups across five countries and managing over $100 million in assets under management (AUM) for thrift groups and enterprise clients that include the staff cooperatives of Sterling Bank, NNPC, and the US Embassy.

For more information, visit www.coopify.africa.