By Elonna AGUH

Research has shown that over the years, the greatest fear of workers especially in the informal sector has been how to live their old age and retirement in relative comfort without being dependent on anyone, the least their children, especially with the recent high level of uncertainty in the country occasioned by dwindling resources, generally low and irregular incomes, economic upheavals and general insecurity.

This category of persons constitutes approximately 70% – 90% of the working population and suggests the urgent need to assist them plan for their old age and retirement on one hand and on the other hand, achieve the Pension Industry’s strategic objective of covering 30% of the working population in Nigeria under CPS by the end of 2024, considering their wide dispersal across the country.

All efforts, therefore, should be in place to extend coverage to this important segment of the Nigerian economy. The formal sector on the other hand has, over the years been captured in a well-organised pension plan, which the informal sector could not boast of.

To ensure efficiency, the Pension Reform Act 2004 was enacted. However, to ensure it has wider coverage, the government enacted the Pension Reform Act (PRA) 2014 which repeals the Pension 1 Act No. 2, 2004 to continue to govern and regulate the administration of the uniform pension scheme for both public and private sectors in Nigeria; and for related matters.

For the informal sector, it was done through the Micro Pension Plan (MPP). This plan helps participants cultivate the habit of saving for their old age while they are still active to provide a steady stream of income in their retirement and old age.

HOW IT WORKS

The MPP is a voluntary pension plan for such persons as traders, members of unions and associations, artisans, stylists and employees in organisations with less than three workers. It is flexible in terms of registration and remittance of contributions and is regulated by the National Pension Commission to ensure the safety of pension assets.

In implementing this initiative, the informal sector has been segmented into three broad categories- the low-income earners, the high-income earners and the SMEs. Each of these categories is targeted with the appropriate pension products and sensitisation programmes that meet their peculiarities.

However, it is evident that a robust technological platform that would support the provision of customer services is necessary to effectively and efficiently register, collect contributions, provide The Retirement Savings Account support, pay benefits and provide financial advisory services to this class of workers.

In some jurisdictions, special mobile phone applications had been successfully implemented for financial transactions including the provision of pension services to the self-employed and informal sector workers.

The success stories of these applications drive the confidence that a similar platform can be designed and implemented in Nigeria. Consequently, the Commission had already commenced the sensitisation of service providers and relevant regulators as well as the targeted workers in the informal sector with a view to creating the enabling environment and buy-in.

Against this development, a department has been established in the Commission to drive the implementation of the Micro Pension Plan. The various stages involved are as follows:

- REGISTRATION – The Prospective Micro Pension Plan Contributor (PMPPC) can register by opening a Retirement Savings Account (RSA) with a Pension Fund Administrator (PFA) of their choice. The minimum age for registration under the micro Pension Plan is 18 years.

- CONTRIBUTION – Contribution could be made daily, weekly or monthly. There is no specified amount for contributions. The contributions have to be made at least once a month.

- FUNDS MANAGEMENT – The Pension Fund Administrator (PFA) manages and invests the contributions on behalf of the contributor for profit. The Pension Fund Custodian (PFC) keeps the money in safe custody. The PFA and PFC are strictly supervised by PenCom.

- FUNDS WITHDRAWAL – 40% of the amount in the Retirement Savings Account (RSA) is available for withdrawal by the contributor to meet urgent financial needs before retirement. 60% is retained and exclusively managed for Pension.

It is important to note that pension can be accessed once the MPP contributor is no longer able to work and has attained at least 50 years of age. To achieve the savings culture in the informal sector, several Pension Fund Custodians and Pension Fund Administrators were appointed to drive the process.

They are to ensure effective management of the funds, ensure Return on Investment (ROI), promote customer care and plan advisories for retirement. Under the CPS, the employer and employee make monthly contributions; the employer contributes 10% while the employee contributes 8%. The money is deposited in the Retirement Savings Account (RSA).

Some of the Pension Fund Administrators in Nigeria are:

- ARM Pension Managers Limited

- Veritas Glanvills Pension Limited

- Crusader Sterling Pensions Limited

- FCMB Pensions Limited 5. Fidelity Pension Managers Limited

- First Guarantee Pension limited

- Guarantee Trust Pension Managers Limited

- Leadway Pension PFA Limited

- Nigerian University Pension Management Company (NUPEMCO)

- Stanbic IBTC Pension Managers

- Sigma Pensions Limited

- Oak pensions Limited

- IEI-Anchor Pension Managers and many others.

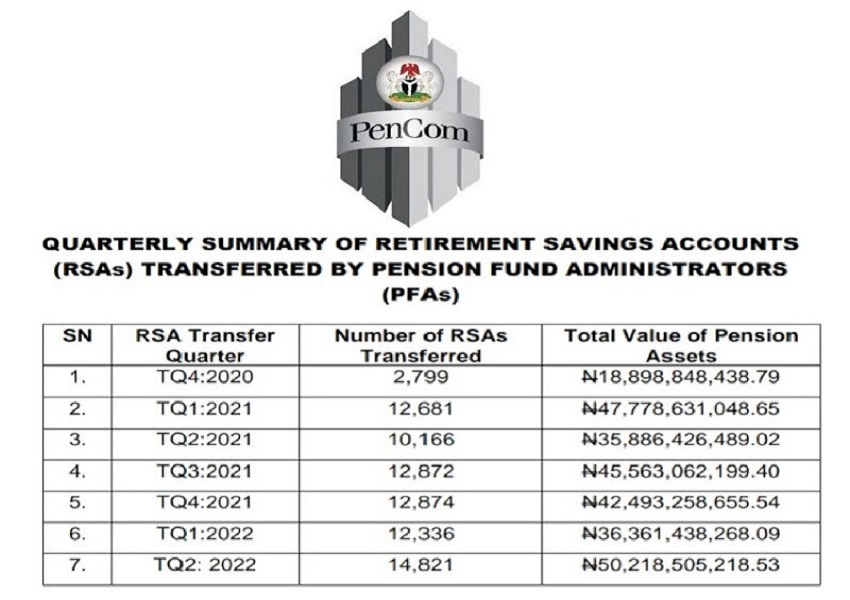

The table below shows the quarterly summary of retirement savings account (RSAs) transferred by Pension Fund Administrators (PFAs) from 2020 to 2022.

***Sir Elonna Aguh, KSM, a public affairs analyst and commentator wrote from Lagos