It has been discovered that the rise in digital payments facilitated by Fintechs, Open banking, and emerging technologies, has led to a marked increase in cybersecurity threats.

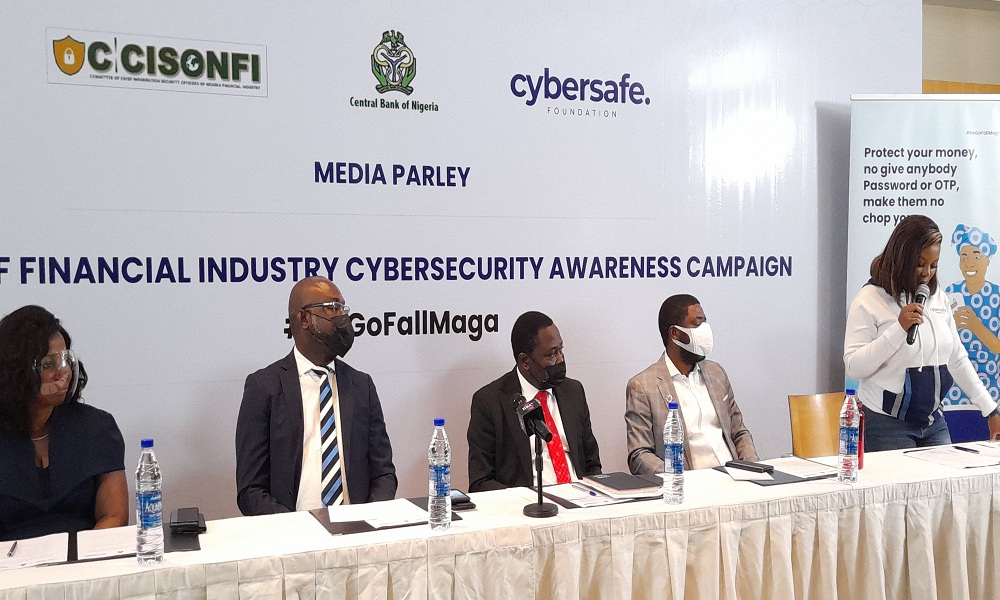

Against this background, the Committee of Chief Information Security Officers of Nigerian Financial Institutions (CCISONFI) in conjunction with the Central Bank of Nigeria and the Cybersafe Foundation, Monday held a parley with a cross-section of the Nigerian media where #NoGoFallMaga, a public enlightenment campaign, and cyber awareness initiative was officially launched.

Speaking at the event, Haruna B. Mustafa, Director of Banking Supervision at Nigeria’s apex bank, the Central Bank of Nigeria (CBN), said that cyber-attacks are not only a major threat to financial system stability through their impact on one institution but also through their impact on multiple components of the financial system.

Mustafa noted that it was for this reason that the development of robust mechanisms to ensure that financial institutions have in place the necessary safeguards to protect against loss of data, fraud, and cyber incursions in their respective systems, was part of the CBN Governor’s 5-year policy thrust of 2019-2024.

Represented by Dr. Adedeji Adetona Sikiru, a Deputy Director in the Banking Supervision Department of the CBN, Mustafa listed some of the steps taken by the apex bank to improve the cyber-resilience of supervised institutions.

According to him, the CBN Risk-Based Cybersecurity Framework and Guidelines for Deposit Money Banks issued in 2018 outlined the minimum cybersecurity baseline to be put in place by Deposit Money Banks and Payment Service Providers.

“It charged the Board of Directors with promoting and overseeing banks internal cybersecurity strategy, while Senior Management was tasked with its implementation.

“It also required each bank to have a Chief Information Security Officer (of appropriate grade reporting directly to the CEO) tasked with overseeing and implementing its cybersecurity programme,” Mustafa said.

While noting that cybersecurity awareness is the totality of efforts made by stakeholders to ensure that customers do not fall victim to the antics of fraudsters and institutions are not held ransom by hackers, he reaffirmed CBN’s readiness to partner with industry stakeholders to sustain efforts at educating staff and customers on fraud information and cybersecurity hygiene practices.

“To this end, the CBN is ready to partner with industry stakeholders to develop awareness programmes that can be integrated into the education system in Nigeria to create a security culture for citizens from childhood,” the CBN Director said.

In his welcome address, Chairman of the Committee of Chief Information Security Officers of Nigerian Financial Institutions (CCISONFI), Mr. Abumere Igboa said the #NoGoFallMaga industry programme is aimed at promoting general public awareness on cybersecurity and looks to reducing cybercrime and financial fraud as a result.

He noted that the success of the programme is largely centred on the strategic trio partnership between the CBN, CCISONFI, and Cybersafe Foundation, an independent non-governmental organisation registered under the laws of the Federal Republic of Nigeria.

“The Committee of Chief Information Security Officers of Nigerian Financial Institutions (CCISONFI) became necessary due to the need to have an industry body supporting the CBN in providing guidance and advisory services related to Cyber, Data and Information Security across the Nigerian Financial & Payment ecosystem as the cyber threat landscape continued to evolve.

“This initiative looks at tackling cybercrime that poses a threat to customers and the Nigerian citizenry in conducting reliable and safe financial services. As Chief Information Security Officers, we have also witnessed increased adoption of digital/technology platforms post the Covid-19 pandemic crisis by our different financial institutions for delivering innovative financial solutions, expanding its operations, and being able to reach both existing and potential customers.

“This Increased use of digital platforms has greatly transformed the cyber and technology landscape thereby coming with its own risk, especially with sustaining trust and confidence in customers’ ability to communicate and transact securely within the financial ecosystem. A loss of such trust and confidence could undermine the benefits of CBN’s cashless economy,” Igboa said.

The CCISONFI Chairman who stated that there was a constant need to address the related challenges of ensuring continuous cybersecurity and data privacy in the country, disclosed that the committee has come to the realization that only through concerted efforts by financial industry stakeholders and ensuring its customers remain cyberaware, can cybersecurity challenges be eliminated or reduced.

“We look forward to a rewarding partnership and successful achievement of our target objectives which include reaching more than 40 million customers in the first two years of its launch and finally delivering awareness contents and messages in major Nigerian languages including pidgin English,” Igboa said.

Executive Director of Cybersafe Foundation, Confidence Staveley while introducing the Foundation to the media during the event, said that with Social engineering being the method of choice by cybercriminals to perpetuate electronic fraud in the country, efforts to educate customers of financial institutions on cyber hygiene best practices, especially the most vulnerable, must be stepped up.

She noted that using traditional platforms or formats may no longer suffice, suggesting that resorting to creative approaches such as using communication channels to reach semi-rural communities, leveraging entertaining music, among others, must be thrown into the mix.

“CyberSafe Foundation is Nigeria’s foremost non-governmental organization in the information security domain, on a mission to facilitate pockets of changes human capacity and behavioral changes that ensure inclusive and safe digital access in Nigeria. We work tirelessly to improve cyber safety in Nigeria, especially for the most vulnerable in our society through our initiatives.

“We create impact through mission-aligned collaborations, social media activism, captivating content, educative social media post, insightful events, media leverage, and laudable programs/initiatives.

“Our Flagship initiative #NoGoFallMaga is a national movement of young people, working to combat preventable digital fraud with consumer-centered sensitization and education. Digital fraud in this context includes email deception, phone-based scams, online fraud – particularly where cybercriminals impersonate trusted organizations. We leverage fun experiences and content, to catalyse the decline of cyber-related fraud, one trickle of knowledge at a time.,” Staveley said.

She disclosed that the partnership with CCISONFI to launch the #NoGoFallMaga Campaign will enable Cybersafe Foundation to join forces to reach the 40 million Nigerians who currently access financial services across the country, raising mass cybersecurity awareness and consequently reducing the success of rate of cyberfraud attacks among customers.

According to her, “There is clearly a need to include an aggressive cybersecurity awareness campaign to compliment other proactive and reactive measures being taken to curb cyber fraud. However, we must collaborate across the financial eco-system, consolidate resources and strengths, and reach across the aisle to sectors like the media for support to drive cybersecurity awareness for significant impact.

“Talking about the media, your importance in shaping society cannot be over-emphasized, we acknowledge this huge role you play and that is why a meeting with you is the first activity on our agenda. Simply put, we need you. We need you to come with us on this journey and work closely with us in fighting the monster called Cyberfraud.

“Just like you helped the Health sector fight Ebola and you are currently helping with fighting misinformation around COVID, we need you to work passionately with us to fight this problem that is threatening digital innovation around financial services.

“In the #NoGoFallMaga campaign, we will be working to significantly reduce the success rate of cyberattacks by raising mass awareness of the top 5 prevalent cyber fraud attack methods and safe cyber hygiene best practices, to all customers of Nigerian Financial Institutions.”

She listed some of the areas of activities of the campaign to include Propagation of the #NoGoFallMaga awareness afrobeat song; Creating and disseminating simple, relatable, actionable, and engaging cybersecurity awareness content to customers base through all bank-owned and bought media channels and touchpoints.

It will also use a mix of print, broadcast, and online media to aggressively create awareness and educate the public on cyber hygiene best practices.

“In the past, we have partnered the UK Government to launch a mass Cybersecurity Awareness campaign under the safe digital community during COVID-19 project, delivering cyber hygiene best practices to the most vulnerable in our communities using novel channels like drama, educational afrobeat campaign song (jingle), social media banners, exciting videos, etc,” she said.