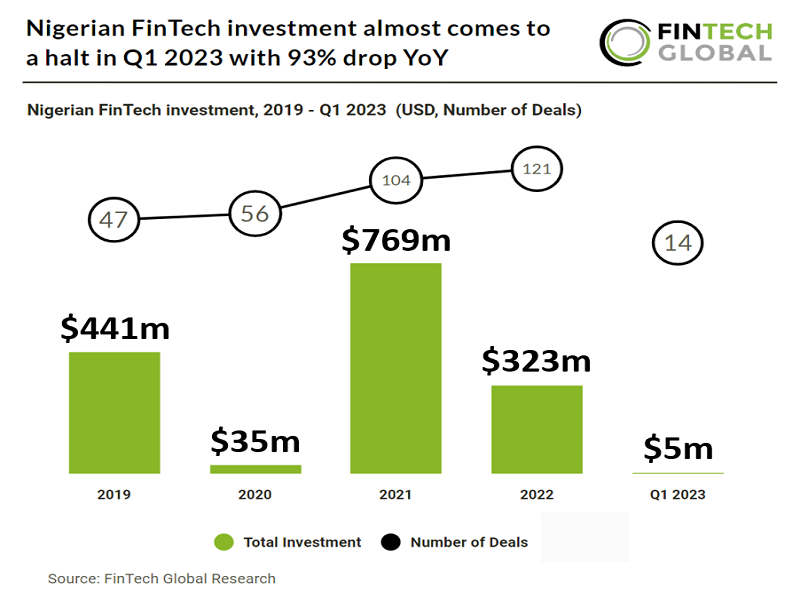

Nigerian Fintech saw a slow start to the year with both investment and deal activity dropping Year-on-Year despite consistent deal activity growth in the past five years, according to a report in Fintech Global.

In comparison to the previous year, Fintech deal activity in Nigeria witnessed a significant decline of 55% in the first quarter of 2023, with only 14 deals recorded.

During Q1 2023, investment in Nigerian Fintech experienced a significant decline of 93% compared to Q1 2022, reaching a total of $5m.

Curacel, a digital insurance solutions provider, had the largest Nigerian FinTech deal in Q1 2023, raising $3m in its latest seed round extension, led by Tencent.

The seed funding will be used to roll out new technology solutions designed to power the next generation of insurance experiences in Africa. The investment will also support the company’s expansion into North Africa.

A participant in the Winter 2022 cohort of Silicon Valley’s prestigious Y Combinator accelerator, Curacel last year launched a new product called Grow, to support more effective distribution of insurance to millions of Africans through partners like Barter by Flutterwave, Float, Payhippo and other leading technology companies.

It also enables the seamless embedding of insurance in customer user journeys.

Curacel has processed more than $100m worth of claims, working with more than 20 insurers and more than 5,000 service providers in eight countries across the continent.

In 2022, Curacel grew its transaction volume by 600% and increased its revenue by 500%. Starting with Egypt and Morocco, the new funding will enable the company to roll out its services in North Africa and deepen its presence in other parts of the continent.

Marketplace lending was the most active Fintech subsector in Nigeria during Q1 2023, with three deals, a 21% share of total deals.

InsurTech, PayTech, PropTech and Blockchain & Crypto were the joint second most active subsectors with two deals each.

In April 2023, regulatory changes in the consumer lending sub-sector of Nigeria aim to address consumer complaints related to privacy rights violations and unlawful debt recovery procedures.

These changes, along with the growing number of market entrants and licensing requirements, reflect the country’s commitment to improving business practices.

Digital lending businesses in Nigeria must comply with a two-level licensing regime, obtaining licenses from local authorities and federal agencies.

Regardless of the type of license, digital loan companies are also required to complete additional mandatory post-license registrations with various federal agencies.