KongaPay, a Central Bank of Nigeria (CBN)-licensed fintech platform, has been identified as the leading provider of digital payment services for e-commerce transactions in Nigeria.

The rating came from Statista, a globally renowned market and consumer data firm.

The development justifies the huge popularity and impressive dominance KongaPay enjoys as a reliable, secure and trustworthy e-payment channel for many savvy users in Nigeria.

Furthermore, the platform, which ranks as one of the thriving subsidiaries in the Konga Group, Nigeria’s leading e-commerce giant, has once again lived up to its billing as one of the top enablers of online shopping in Africa’s biggest market.

“In 2020, e-wallet held about 10 per cent of digital payments in Nigeria. The most common service was KongaPay, which accounted for four per cent of the payments, while PayPal followed with three per cent,’’ research from Statista disclosed.

‘‘Overall, cash and bank transfers were the second most common payment methods in online retail after cards. However, data on credit card penetration in Nigeria show that the share of people owning a credit card is quite low,” it added.

KongaPay has recorded significant growth since the landmark acquisition of Konga by Zinox a little over three years ago. The platform has witnessed an impressive 700% growth in the number of existing wallets, with projections indicating a rise to over one million wallet holders by the end of 2021.

Instructively, the dominance of KongaPay in e-wallet transactions in Nigeria has hardly come as a surprise to the Management of Konga, which has disclosed that more landmark strides are on the way, not only for the fintech platform but for the other thriving verticals under the Konga Group umbrella.

Lending more insights into the massive groundwork going on behind the scenes to further grow its market share, Isa Aliyushata, Vice President, KongaPay is bullish about the chances of the platform taking its popularity as a trusted e-commerce payment vehicle to other African markets.

‘‘E-commerce is growing in Nigeria and compared to when the bug first bit, the proportion of those making online payments is also gradually hitting an upward curve. Now, for most e-commerce shoppers willing to make payments digitally, a few considerations are paramount. These include security, reliability, user-friendliness, convenience, and, of course, safety.

‘‘KongaPay offers all these and much more.

‘‘We have not only built a robust and reliable payment platform but have also done a lot of work in expanding the scope of services being offered by KongaPay.

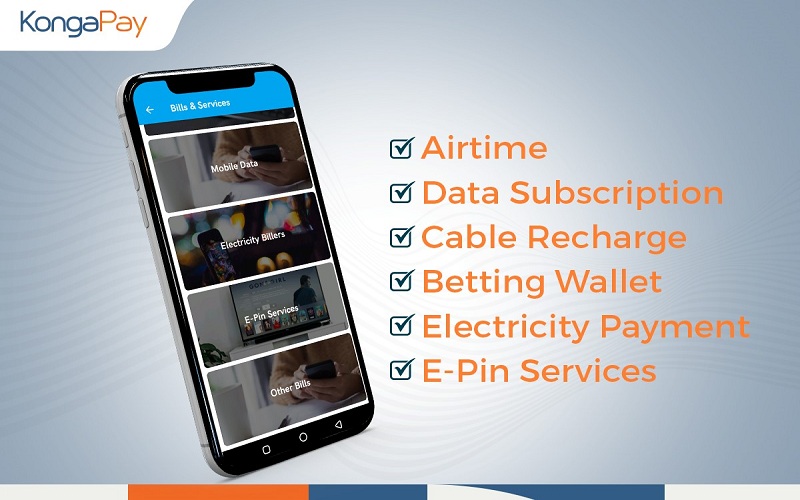

“Today, with KongaPay, you can make cardless withdrawals for all banks in Nigeria, transfer money to individual accounts or various accounts at once, receive payments from customers, creditors or benefactors through a variety of means, buy airtime from various telcos or network providers such as MTN, Airtel, Glo and 9Mobile, etc., pay for or renew your internet subscriptions, recharge and pay for electricity digitally, renew your cable TV subscription including DSTV, GOTV, IrokoTV, etc., pay for flights, travel and hotel accommodation, fund your sports betting, lottery and gaming accounts and also use it as a mobile money wallet, among others.

“KongaPay is also in the forefront of promoting financial inclusion across the reached, the unreached and under-served segments of the populace. We are doing a lot in this regard through the engagement of KongaPay mobile money agents across the nooks and crannies of Nigeria, while also recently extending our services to Nigerians in the Diaspora, many of whom have often struggled to find a reliable way to extend support to their families and relatives back home, make payments to suppliers or even receive payment for the goods and services they sell here.

“We are confident of growing our share of the digital payments market, while also not ruling out expansion into other African markets,” he disclosed.

Launched in 2015, KongaPay debuted as a pilot product in partnership with Nigerian commercial banks in response to concerns expressed by customers about the confidentiality of their details while trying to make payment for products on the Konga website.

Since its inception, the platform has grown immensely and under the drive of the new management of Konga, is leading the new-found appetite for digital payments among e-commerce patrons and other subscribers, processing tons of transactions on a daily basis.

Also sharing his thoughts on the impressive growth trajectory of KongaPay and other subsidiaries within the e-commerce giant’s fold is Nick Imudia, Co-CEO, Konga Group.

“Alongside KongaPay, through which we are bringing more Nigerians into the financial inclusivity index, there is a lot more to be enthusiastic about within the Konga Group.

“Among these is our growing portfolio of physical stores spread across Nigeria’s vast landscape which also serve as collection centres for many shoppers; Kxpress, our in-house digital logistics and delivery company which has not only demystified logistics but also handles complicated projects and other deliveries for external parties; Konga Travel, a leading IATA-certified online travel and tours agency with a string of credible local and international awards to its name all within three years.

“There is also our latest entrant, Konga Health, a digital health care distribution chain which has garnered all statutory certifications and already partnered with the Association of Private Medical Doctors to boost the scope of quality healthcare products and supplies deliveries in Nigeria; as well as the soon-to-be-launched Konga Food, for which we have almost concluded a pilot phase.

“Through these platforms and others which are still in the pipeline, we are raising the bar of standards and service delivery in the e-commerce sector and giving Nigeria and indeed Africa an indigenous brand they can be proud of,” he concluded.