By Uchechukwu Favour Nmesoma

In 2023, an 18-year-old Nigerian student named Ola downloaded a digital wallet app to manage his finances. Within minutes of installation, he received a loan offer referencing his admission into a federal university—information he never disclosed on the app. This eerie precision raised the question: how did the app know?

In digital marketing today, personalisation is driven by algorithmic marketing, where AI-powered systems tailor content, recommendations, and offers based on user behaviour. But this convenience comes at a price: digital privacy—users’ control over the collection, use, and sharing of their data.

Across Africa’s rapidly evolving financial sector, brands are harnessing personalisation to drive engagement, yet many lack robust privacy protocols. While personalisation boosts user conversion, it often sidesteps consent and transparency, creating ethical and regulatory concerns.

This article explores the dynamic intersection of personalisation and privacy in African FinTech, spotlighting both its potential and perils.

The Power of Personalisation in African FinTech

African FinTech is transforming how people access and use financial services. Apps like Carbon, Chipper Cash, and Flutterwave now leverage behaviour-tracking algorithms, geo-targeted promotions, and tailored notifications to create hyper-personalised user journeys.

During my time as a digital marketing manager at Heels and Tech, we used personalisation not just to sell a product, but to build relevance. Our goal was to help women transition into tech. Initially, the ads were generic. I recommended tailoring them to resonate with specific categories of women—breastfeeding mothers, stay-at-home moms, recent graduates, college students, and more. We created content for each audience. The impact? Increased engagement and higher conversion rates across segments.

Personalisation, when done right, creates inclusivity and builds emotional connection. For many African FinTech startups, it has become a growth lever, helping them scale faster by speaking directly to user needs.

Privacy in Peril: The Risks Behind Personalisation

It has become unfortunate that most of the time, this personalisation often happens without user knowledge or consent. Many apps collect far more data than necessary—from location to contact lists—without clearly explaining why. This overreach erodes trust, particularly when sensitive financial data is involved.

In Ola’s case, the app accessed data he hadn’t explicitly provided. This isn’t unique—many African FinTechs use third-party data brokers or AI models that scrape metadata and app activity.

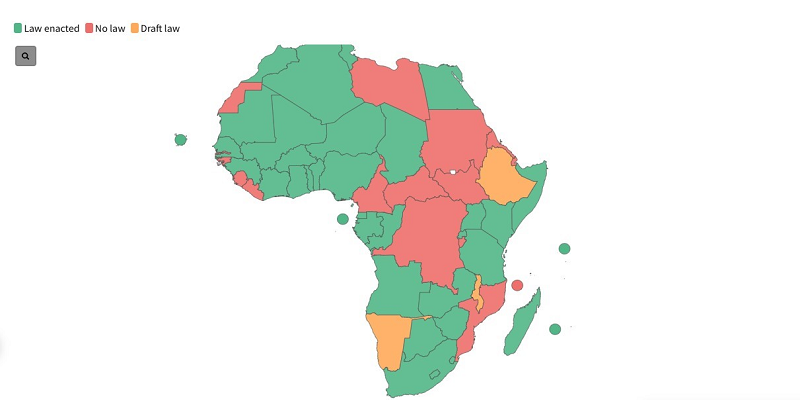

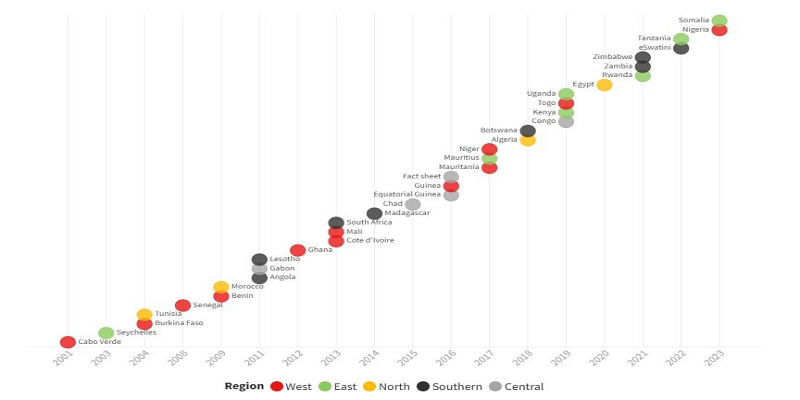

Globally, regulations like GDPR (Europe) and CPRA (California) emphasise informed consent and data minimisation. But in Africa, according to Advisory (2023), as of February 2024, only 36 out of 55 countries have enacted data protection laws, with 3 in the draft phase. As the visualisation below shows, there has been a steady increase in the number of data protection laws enacted in Africa, especially in the last decade, with a third of them being passed in the last five years.

Without proper safeguards, personalisation becomes surveillance, and the cost is users’ digital dignity.

Youth and Digital Consent: A Generation at Risk

Young people, especially Gen Z and young millennials, form the largest user base of mobile FinTech apps in Africa. From instant loan platforms to digital savings accounts, they are drawn to services that promise speed and convenience. Yet, they are also the most affected by a lack of adequate data privacy.

Many of them do not read Terms and Conditions or understand what it means to “accept cookies.” Their consent is often uninformed or coerced. This makes them easy targets for algorithmic profiling and predatory marketing.

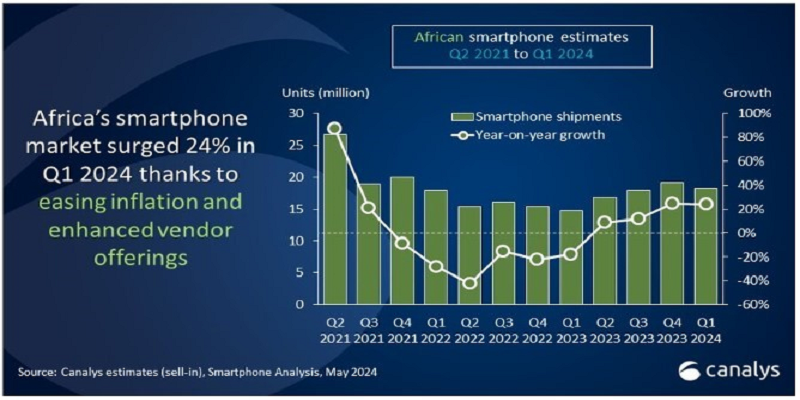

In 2024, smartphone sales in Africa rose by 24%, and mobile-first FinTech platforms expanded rapidly. But with this surge comes the risk of manipulative personalisation—nudging young users toward debt or risky investments based on behavioural patterns.

We must question whether personalisation is helping young users or quietly exploiting them.

Striking the Balance: Ethical Personalisation

Ethical personalisation is not a contradiction. It’s a blueprint for using AI to engage customers while protecting their rights.

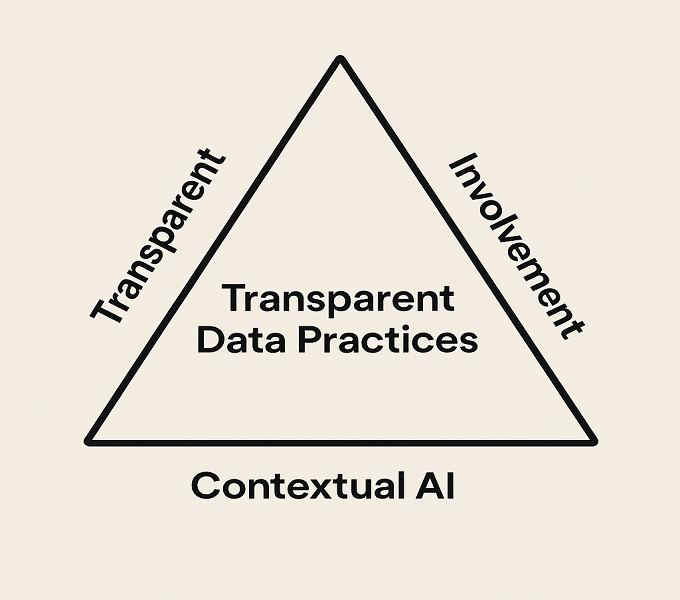

Three pillars support this balance:

- Transparent Data Practices: FinTechs must adopt consent-first models, practice data minimisation, and ensure users know how their data is used. This builds trust and prevents backlashes.

- Contextual AI: There must be a balance between personalisation benefits and safeguarding of customer rights and confidential information. The use of data encryption and anonymisation will aid in limiting unauthorised access to customer data. Algorithmic bias must also be protected against, as that can lead to unfair and discriminatory outcomes.

- Community Involvement: Products must incorporate the user perspective and preferences. Engaging local communities in product design helps FinTechs respect user values and expectations.

These three pillars form what I call the Ethical Personalisation Triangle, a framework that balances innovation with accountability.

The Role of Regulation and Collaboration

Privacy cannot be left to developers alone. Governments, companies, and users must collaborate.

Africa urgently needs a Pan-African GDPR-style framework to unify data protection standards and enforce compliance. But regulation must be paired with digital literacy—users must understand their rights and the risks.

As Trott (2023) notes, while 36 African countries have DPAs (Data Protection Authorities), many lack autonomy or funding. True independence is key to building a regulatory environment that serves users, not just the market.

Developers, meanwhile, must lead with ethics. Self-regulation, transparency, and cross-sector partnerships with legal, ethical, and academic bodies will help African FinTechs scale sustainably.

Conclusion

The algorithm is always listening—but it doesn’t have to overstep. As personalisation reshapes African FinTech, so must our understanding of digital rights.

We must move beyond convenience to consent, beyond clicks to community-centred design. Startups must champion ethical innovation, and regulators must provide the guardrails.

To young FinTech professionals: “The algorithm is only as ethical as the humans behind it.” Africa has the opportunity to lead, not by copying the West, but by charting a path that protects its people as much as it serves them.

The future is personal. Let’s make it ethical, too.

ABOUT THE AUTHOR

Uchechukwu Favour Nmesoma is a visionary marketing leader, driving growth for top brands with her data-driven approach and innovative campaigns. With expertise spanning e-commerce, EdTech, entertainment, and FinTech, Favour has delivered remarkable results, including 40% conversion rate surges and 70% increases in email engagement.

Passionate about giving back, Favour volunteers her expertise to empower young African minds. A soon-to-be author, she’s dedicated to educating entrepreneurs about the transformative power of digital marketing. Favour continues to inspire others with her remarkable journey.