By Elonna AGUH

Pension benefits have over the years been a thorny issue government contends with. This was occasioned by the unfunded Defined Benefits Scheme of the public sector, with the attendant challenge on the government to contend with the payments of retirement benefits as captured in her annual budget.

The annual budgetary allocation for pensions was often one of the most vulnerable items in budget implementation in light of resource constraints. There are instances where budgetary provisions were made but bureaucracy, occasioned by the untimely release of funds resulted in delays and a backlog of pension payment rights. It, therefore, became very obvious to the government that the Defined Benefits Scheme was unsustainable.

On the other hand, many employees in the private sector were not covered by the pension scheme put in place by their employers and so many of such schemes were not funded either. In the instances where they were funded, the scheme was bedeviled with several irregularities and malpractices as observed between the Fund Managers and the Trustees of the pension funds.

In 2004, under the leadership of President Olusegun Obasanjo GCFR, the pension administration in Nigeria decided to address headlong, these monstrous, hydra-headed challenges and accordingly, it initiated a pension reform to address and eliminate the problems associated with pension schemes in the country.

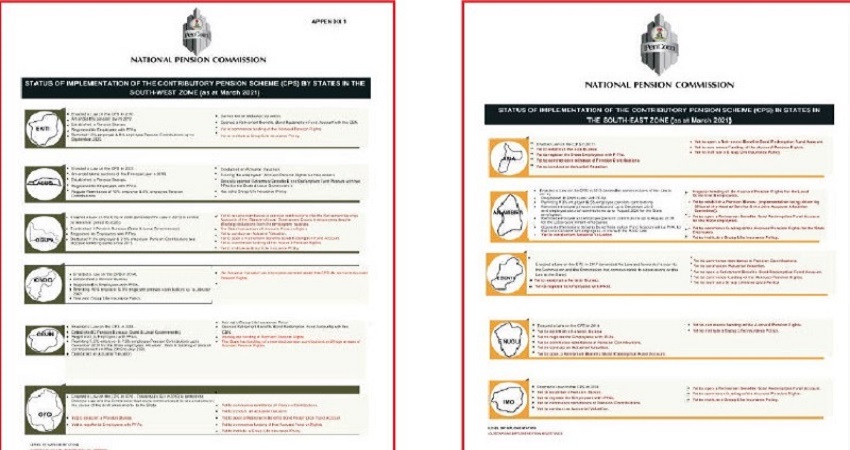

To this end, the chats below give a detailed status of the implementation of the contributory pension scheme (CPS) by States in the six zones of the Federation as of 31st March 2022.

This proactive move birthed the enactment of the Pension Reform Act (PRA) 2004. The Commission has a clear Vision, Mission, and Objectives to actualize the feat.

The Vision

To be a world-class organization that ensures prompt payment of retirement benefits and promotes a sustainable pension industry that positively impacts the economic development of Nigeria.

The Mission

To be an effective regulator and supervisor that ensures the safety of pension assets and a fair return on investment utilizing appropriate technology with highly skilled and motivated staff.

With the economic and social challenges confronting the nation and her appendages, the government once more thought it wise to review the pension act of 2004. However, this time, to further ensure that it captures a wider coverage of people of pensionable age, it enacted yet another Pension Reform Act.

This act repeals the Pension Act Reform Act No.2, 2004 and enacts the Pension Reform Act, 2014 to continue to govern and regulate the administration of the uniform contributory pension scheme for both the public and private sectors in Nigeria; and for related matters.

The Objectives

The objectives of this Act amongst many others are to:

- Establish a uniform set of rules, regulations and standards for the administration and payments of retirement benefits for the Public Service of the Federation, the Public Service of the Federal Capital Territory, the Public Service of the State Governments, the Public Service of the Local Government, and the Private Sector.

- Make provision for the smooth operations of the Contributory pension Scheme;

- Ensure that every person who worked in either the public Service of the Federation, Federal Capital Territory, States, and Local Governments or the Private Sector receives his retirement benefits as and when due; and

- Assist improvident individuals by ensuring that they save in order to cater to their livelihood during old age.

Since the advent of the indefatigable administration of President Muhammadu Buhari GCFR, the leadership of the National Pension Commission has worked assiduously towards ensuring the smooth implementation of the PRA 2014.

The success story of PenCom is unending; let us look forward to more facts on the Savvy Story of PenCom in our subsequent editions.

**Sir Elonna Aguh, a Public Affairs Analyst and Commentator, wrote from Lagos