Sparkle, a mobile-first digital bank that provides financial, lifestyle and business support services to Nigerians across the globe, has raised an oversubscribed seed round of $3.1m [N1.3BN] from an all-Nigerian group of investors.

The investors include Leadway Assurance, Trium Networks and a number of Nigerian HNIs.

This follows a previous friends and family pre-Seed round totalling $2m [N857m], bringing Sparkle’s total funding to $5.1m [N2.1bn].

The new investment will be used to scale the platform’s talent teams across engineering, financial risk and marketing departments and investing in its automated back end processes and digital infrastructure.

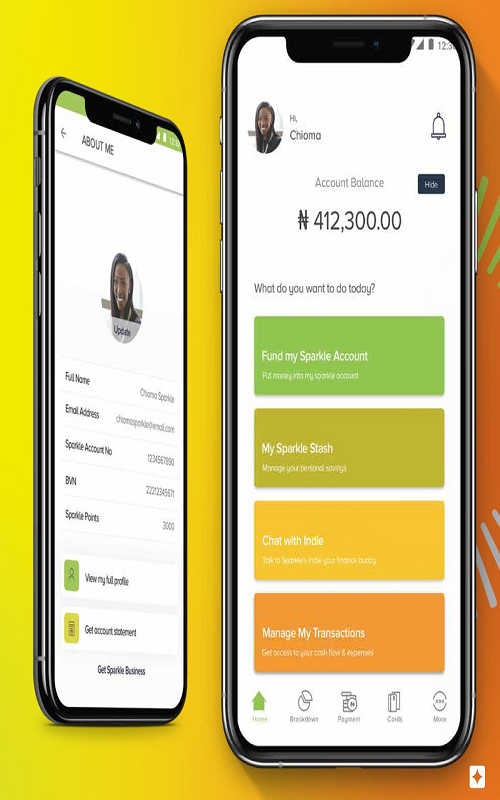

Since launching in 2019, Sparkle has developed a digital-first tribe of users who have access to features such as savings, bill payments, airtime/cable/utility/transport top-ups, the ability to request or send funds, split bills, review spending breakdowns and more, all via the Sparkle app [on the App Store and Google Play].

Sparkle has seen triple-digit growth between 2020/21 and will now continue its focus of connecting Nigerians and the global Nigerian Diaspora by building a different type of financial services platform that is more than just banking, but a means of improving the financial lifestyle of its users, allowing for borderless transactions.

In April 2021, Sparkle launched its business platform, Sparkle Business, targeted at the new generation of digital-first MSMEs and SMEs in Nigeria, with features such as Inventory and Invoice Management, a Payment Gateway Service, Tax Advisory/Calculations and Payroll/Employee Management.

Sparkle Business is the only Nigerian business account where no documentation is required to open an account – to register individuals require a personal Sparkle account, Tax Identification Number [TIN], and an email address connected to their TIN.

Speaking on the round, which is made up in its entirety by Nigerian investors, Uzoma Dozie, Sparkle Founder and CEO, said, “I’m delighted to be collaborating with a group of highly respected Nigerian businesses, investment firms and captains of industry – all of whom understand the real need for a digital-first platform such as Sparkle, to bring better access to financial services and, importantly, financial inclusion, to millions of more people – for business, for personal means or both.

“Collectively, as a group of investors and business builders, we are Nigerians who are bullish about Nigeria and the opportunity the country presents in terms of building global networks and communities, all via one app. I am excited to welcome our new investors into the Sparkle tribe and will be leaning on their sector expertise and insight to build long-lasting partnerships as we scale.”

Sparkle users are able to open an account in less than five minutes via a Smartphone, without the need for documentation or in-person / banking hall verification. The platform also has a Visa card function for users to make in-person or digital payments.

The platform has also secured partnerships with Visa, Network International, PriceWaterHouse Cooper Nigeria and secured a Microfinance Bank licence from the Central Bank of Nigeria (CBN).

Uzoma concludes, “The future is about platforms, and connected platforms, to create a seamless customer experience and, as we say, helping our users do what they want to do.

“Sparkle’s mission is to help Nigerians fulfil their potential by democratizing access to valuable solutions for their business and personal needs.

“Nigeria has a massive youth population who increasingly live, work and play beyond physical borders – we build with them in mind; Whether we are building services for individuals or businesses, we’re fully focussed on creating a connected tribe of Sparklers.”